Saving Strategies for Students: Practical Tips for Financial Success

Being a student often means living on a tight budget, but that doesn’t mean you can’t save money and achieve financial success. With the right strategies in place, you can effectively manage your finances and build a secure future.

Learning Outcome:

After reading this article, you should have learned valuable strategies for effectively managing your finances as a student. These include creating a budget, tracking expenses, taking advantage of student discounts, buying used or borrowing when possible, and cooking at home to save money. By implementing these tips, you can develop good financial habits and work towards achieving your financial goals.

Here are some practical tips for saving money as a student:

Create a Budget:

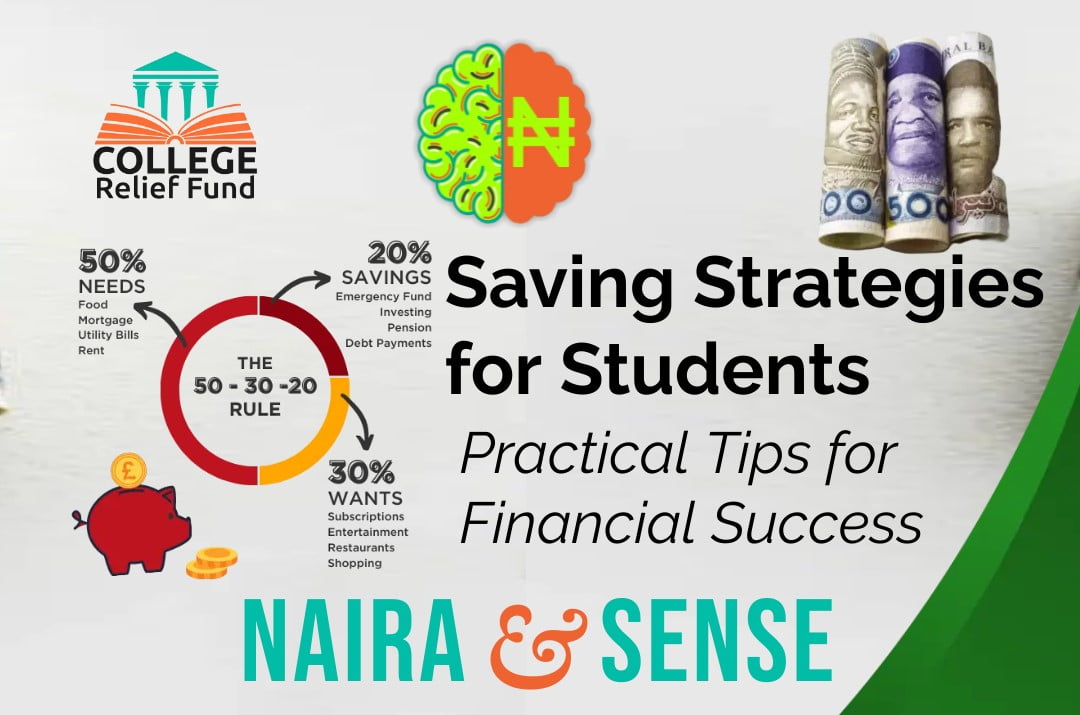

Start by creating a monthly budget that outlines your income and expenses. Be sure to include all sources of income, such as part-time jobs or allowances, as well as fixed expenses like rent, utilities, and tuition fees. Allocate a portion of your income to savings and stick to your budget to avoid overspending.

Example: Suppose you earn ₦40,000 per month from a part-time job. After accounting for rent (₦10,000), utilities (₦5,000), and other expenses, you allocate ₦10,000 to savings each month.

You can see a more detailed lesson on Budgeting in the Naira & Sense Series HERE

Track Your Expenses:

Keep track of your spending to identify areas where you can cut costs and save money. Use a budgeting app or simply jot down your expenses in a notebook to see where your money is going. Look for unnecessary expenses that you can eliminate or reduce to save more each month.

Example: You realize that you’re spending ₦10,000 per month on drinksand snacks. By cutting back to just ₦5,000 per month, you can save ₦6,000 each month.

Take Advantage of Student Discounts

Some businesses or business owners offer discounts to students, so be sure to take advantage of these savings whenever possible. Whether it’s discounts on food, clothing, entertainment, or transportation, every little bit helps. Always carry your student ID with you and ask about discounts wherever you go.

Example: You can save money on movie tickets by showing your student ID at the box office.

Buy Used or Borrow When Possible

Instead of buying brand new items, consider purchasing used or borrowing items from friends or classmates. Whether it’s textbooks, clothing, phones, electronics, or furniture, buying second-hand can save you a significant amount of money. Explore online marketplaces, thrift stores, or campus swap groups to find affordable options.

Example: Instead of buying a new laptop, consider purchasing a quality, used laptop from a reputable seller. You can save thousands of naira while still getting a reliable device.

Cook at Home and Pack Meals

Eating out can quickly drain your bank account, so opt for cooking at home and packing meals whenever possible. Not only is homemade food more affordable, but it’s also healthier and allows you to control portion sizes. Invest in basic cooking utensils and learn to prepare simple, nutritious meals that you can enjoy throughout the week.

Example: By cooking at home and packing your lunch for school, you can save approximately ₦5,000 to ₦10,000 per week compared to eating out every day.

Conclusion:

In conclusion, mastering saving strategies as a student is essential for long-term financial success. By adopting a disciplined approach to budgeting, tracking expenses, and maximizing discounts and savings opportunities, you can build a solid foundation for your future. Remember, saving money requires commitment and sacrifice, but the rewards—financial security and independence—are well worth the effort. Review your budget plans regularly, stay focused on your goals, and continue to seek opportunities to save and invest wisely.

Through careful planning and smart financial choices, you can navigate your student years with confidence and set yourself up for a prosperous future.

Comments (86)

This is so encouraging

Amazing

Thanks for this

Good content, wise spending, saving money, budgeting and frequent review all this is good, but studentship of this days aren’t same as of the old, the rate of feeding alone

However we keep pushing

Tho saving can’t be inclusive cause available funds itself is insufficient

Thanks for the lecture. Putting them into practice will go a long way in helping me

Very Educative

This is really great. Good to save for the future.

Interesting

On naira & sense: how to budget for college expenses In Nigeria.; mastering saving strategies as a student is essential for long-term financial success,

in conclusion, Through careful planning and smart financial choices, you can navigate your student years with confidence and set yourself up for a prosperous future.

It’s fruitful

THANKS FOR PROVIDING THIS LESSONS IN ORDER TO EXTEND OUR KNOWLEDGE,AND SUPPORT OUR ECONOMIC.

THANKS ONCE AGAIN

Well said

I have really learned that savings has good future benefits

God bless

Super educative I have learnt a lot today

Well it is true and I will try and use this strategy

This is a nice lessons I understood it very well

Insightful

Appreciate

I’ve just learned things that I suppose to learn before entering school

Thank you for lesson

This is educative 💯

Now I know the essence of saving and most time it do help me in an unforeseen circumstance

Very good

Nice 😊

Educative! I honestly think a course on finance (how to make and manage money) should be made compulsory for students these days. Financial stability starts from you knowing how to manage your finances. Imagine an educational system designed to help students create wealth while learning, with the help of the school.

Very insightful and practical article on saving. I do have a question, how do you budget effectively when the time for receiving income is not fixed?

All these ideas are awesome I will make sure I put them into practice

🙂🙂

Thank you so much for this exposing this secret to me

I learnt a lot from this thank you so much 🤗

Awesome…i love this

This is great and I’ve learned a lot

Wow, this content delivered beyond what I was expecting,

God bless CRF

Wow

Insightful

Am looking forward to the consideration of CRF in the forthcoming scholarship opportunity

Great content 👍

Good saving strategies, keep up the good work CRF.

This is really great and helpful

Good content

Thank you

Good 👍

It really encouraging

I love this God bless

Great

Very educating

This is awesome and very very helpful thanks for this

Thanks for providing this article very educative

It really helped

Wonderful

Thanks

This is enlightening. My time wasn’t wasted at all. Thank you for this write-up.