Naira and Sense: How to Budget for College Expenses in Nigeria

Education is an investment in your future, but it often comes with a hefty price tag. In Nigeria, the cost of tuition and college expenses has been on the rise, making financial literacy a crucial skill for students. Whether you’re a current student or planning to enrol in higher education, understanding how to manage your expenses can alleviate financial stress and set you up for success.

In this post, we’ll explore practical tips and strategies to help Nigerian students navigate the financial challenges of pursuing a degree.

- Create a Realistic Budget

The foundation of financial literacy starts with a budget. Begin by assessing your income, which may include scholarships, part-time jobs, or support from family. Then, outline your monthly expenses, such as tuition, accommodation, transportation, books, and daily living costs.

Creating a budget allows you to see where your money is going and helps you make informed decisions about your spending.

- Explore Scholarship Opportunities

Scholarships can significantly reduce the financial burden of college. Research and apply for scholarships that align with your academic achievements, interests, and background.

Organizations like the College Relief Fund, Shell, MTN, Federal Scholarship Board and some states offer scholarships to deserving Nigerian students. Don’t underestimate the impact of smaller scholarships; they can add up and make a substantial difference in covering your expenses.

- Consider Part-Time Work

Balancing work and academics can be challenging, but part-time jobs can provide valuable income and work experience. Look for on-campus or remote job opportunities that allow you to earn money without compromising your studies. Many institutions offer a timetable that can allow students to work part-time.

- Buy Used and Save

Textbooks and study materials can be expensive. Consider buying used textbooks, borrowing from the library, or exploring digital resources. You can also collaborate with classmates to share the cost of textbooks. Additionally, look for student discounts on software, electronics, and other essentials.

You may need to use your school email address to access some online discounts for students. Ensure you have it handy. It may look like something similar to [email protected]

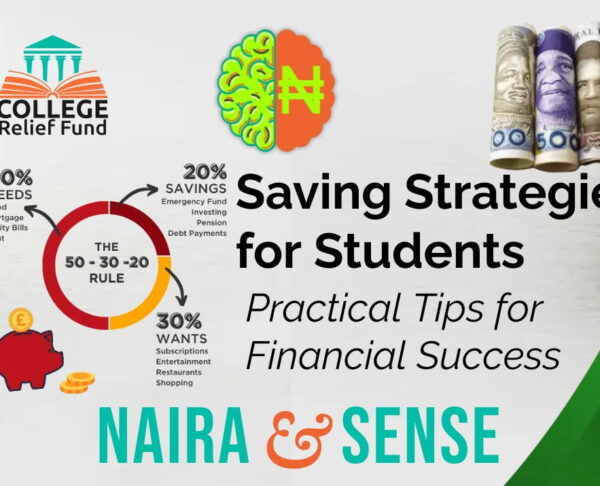

- Minimize Unnecessary Expenses

Identify areas where you can cut back on spending. Reduce dining out and opt for homemade meals. Limit unnecessary subscriptions or memberships to platforms such as Netflix, Hulu etc.

Taking small steps to minimize discretionary spending can free up funds for critical expenses.

- Emergency Fund

Unexpected expenses can arise at any time. Establish an emergency fund to cover unforeseen costs like medical bills or repairs. Aim to save at least two to three months’ worth of living expenses in your emergency fund.

- Seek Financial Advice

Don’t hesitate to seek financial advice from experts or university resources. Financial literacy programs and workshops are often available on campuses to help students make informed financial decisions. Reach out to your college’s financial aid office for guidance on managing your finances.

- Stay Informed

Stay updated on changes in tuition fees, scholarship opportunities, and financial aid programs. Being informed allows you to adapt your financial strategy to your changing circumstances.

Conclusion

Managing college expenses in Nigeria requires careful planning, discipline, and financial literacy. By creating a budget, exploring scholarships, working part-time, and making wise financial decisions, you can pursue your education with confidence. Remember that financial challenges are part of the college journey, but with the right strategies, you can successfully navigate them and invest in your future.

Comments (105)

Perfect

Blessed

That’s awesome

Perfect

Great

This really make me who I was today

How do u get started pls

Great

Loved it

Thank you for the knowledge

Thanks for this enlightenment

Wow

Thanks so much. This information is helpful

Thanks for the information

Nice

Waow this great

It’s very educative and I enjoyed it

This is an eye opener

wonderful

I love this

I know one i will want to help out too

Thank you so much 🙏

I love this

Hmmm… here lies the key to financial stability

Noted CRF through the Sense and Naira …

This is very convincing and inspiring.

Well spoken! More grace to the CRF Initiative. Thanks for everything and the updates.

great

Information is power

Thanks alot

Awesome 👍

Nice

Wow! This is great

Perfect and knowledgeable thanks

Done ☑️

Thanks….

Awesome

Thank you very much

Good

Thanks

Really inspiring.

Thank you for enlightening me,i will definitely put it into practice

This was really helpful, I will put in my best

This is wonderful

Nice update

It’s a great points towards financial management in our fluctuating economy

Am inspired

Great

Thank you for the knowledge. I’ll definitely make use of the points given.

I don’t know how to thank you guys enough for the knowledge I’ve gathered so far☹️☹️☹️Thank you so much. 🥰😍🥰😊

Thank you so much, this is so helpful 🥺🙏

Thank you for the shared information